© 2026 ALLCITY Network Inc.

All rights reserved.

Would it be worth it for the Denver Nuggets to re-sign Danilo Gallinari to a multi-year contract averaging $23.5 million a year?

If you’re anything like me, it is still hard to wrap your mind around the concept that Gallinari will probably land a contract of that magnitude, let alone the maximum contracts in the $32 million to $40 million per year likely to be paid to top-flight flight free agents like Blake Griffin and Paul Millsap.

When I first started writing extensively about the Nuggets and the NBA, it was the 2005, and Kenyon Martin was Denver’s highest paid player, earning $10.6 million that year. Even as recently as 2015-16, Gallinari’s salary of $14 million – not significantly higher than Martin’s considering ten years had passed – topped the Nuggets’ payroll.

When it came to understanding and appreciating the game and the league on some deeper levels, as part of the collective bargaining agreement, and the importance of more advanced-statistical metrics, my formative years started with the proliferation of more high-quality basketball writers, blogs, and resources.

And while things were not entirely static in the NBA – the 2011 lockout resulted in a new CBA, with improved understanding of analytics that led to teams placing greater emphasis on at-rim and 3-point shot, structural change on the payroll front was enough that knowledge learned in 2006 of the salary cap, luxury tax and various types of contracts was still applicable in 2014.

Summer 2016: The first wave of the salary cap spike

In 2016, however, some of these older conceptual frameworks started to break down, particularly in terms of how much players “should” get paid – “should” in the sense of the dollars per year which would approximately match the market value of specific calibers of players.

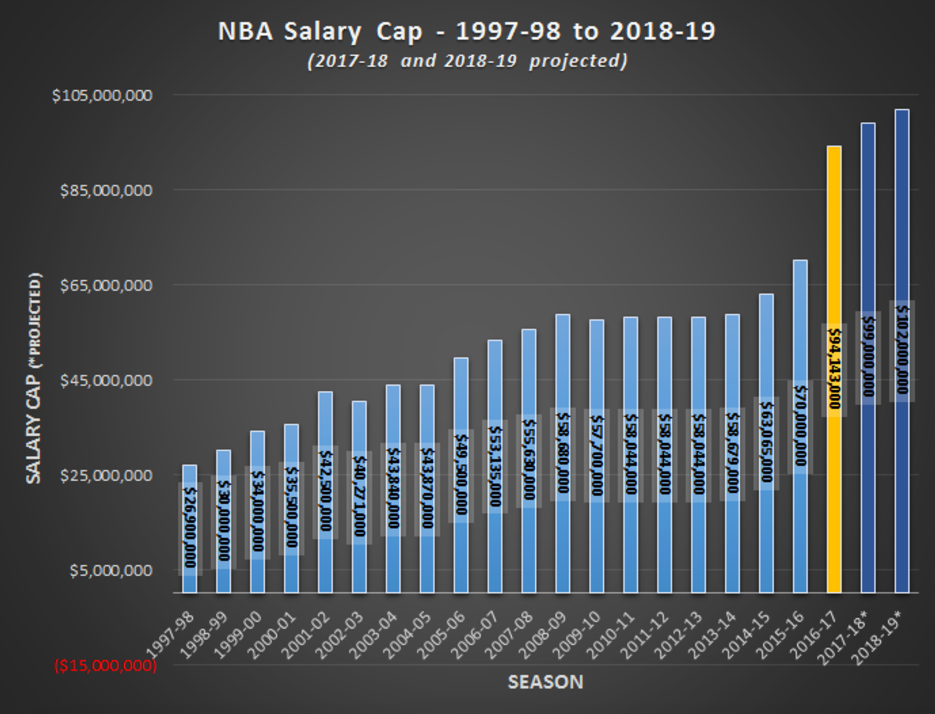

One impact of the massive money influx came with the league’s 2014, nine-year, $24 billion TV deal that inflated the NBA salary cap $24.1 million in a single season. It was about $4 million more than the $20.5 million the cap had incrementally increased in the 11 preceding seasons.

When the floodgates of free agency burst open last summer, we started to see the true impact of how this new vaulted salary cap landscape would boost the pay of its players to unprecedented levels.

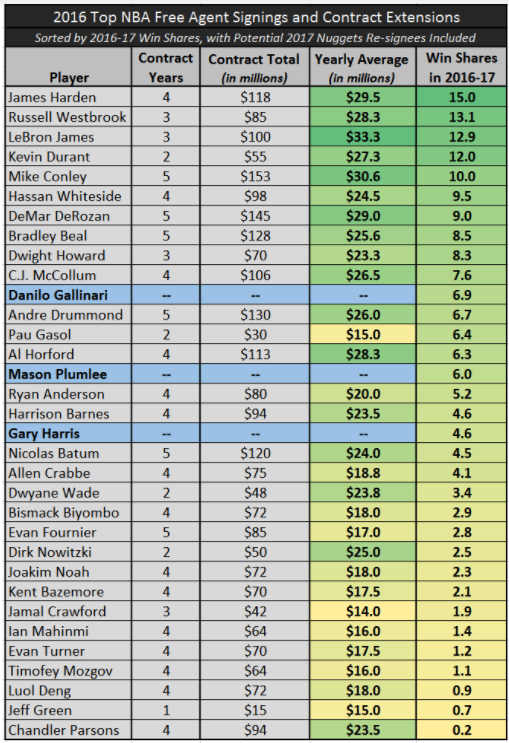

Among the more eye-popping deals: The Portland Trail Blazers awarded Evan Turner a four-year, $70 million contract. The New York Knicks paid the chronically injured Joakim Noah $72 million for four years. And the Dallas Mavericks signed Harrison Barnes to a four-year, $94 million deal.

Below is a table of last summer’s top-dollar free agent signings and contract extensions, sorted by the win shares tallied by each player in the subsequent season. Included in the table for context of where key Nuggets players stand to win shares are Gallinari, who has opted out to become an unrestricted free agent this summer, Mason Plumlee, who is restricted, and Gary Harris, who is eligible for a contract extension, an opportunity the team would be wise to jump on proactively.

(Stats and salaries in this article from Basketball-Reference.com and Patricia’s Various Basketball Stuff)

The respective dollar amounts shown in the table above which were paid to players with similar win share totals as Gallinari, Plumlee, and Harris may rightfully give fans pause as a harbinger of exorbitant payouts to come for the Nuggets, as players will certainly be making a push to get paid as well as their colleagues who have provided similar production.

While it should be pointed out that, of course, a wide range of factors including age and injury history go into determining salaries, win shares are used here as just one example of how, for instance, Gallinari’s agent will be able to argue that he was significantly more productive than Barnes and Chandler Parsons – both of whom got contracts averaging $23.5 million a year.

But setting aside for the moment whether or not it would be wise for the Nuggets to re-sign Gallinari to a contract in the $23.5 million a year ballpark, and zooming out to the larger situation, another more general question presents itself:

Are all these high-priced salaries really as crazy as they seem?

Revisiting the salaries of past seasons

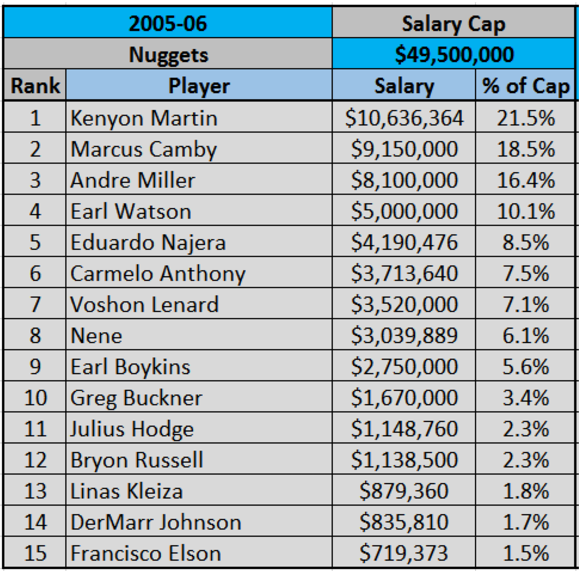

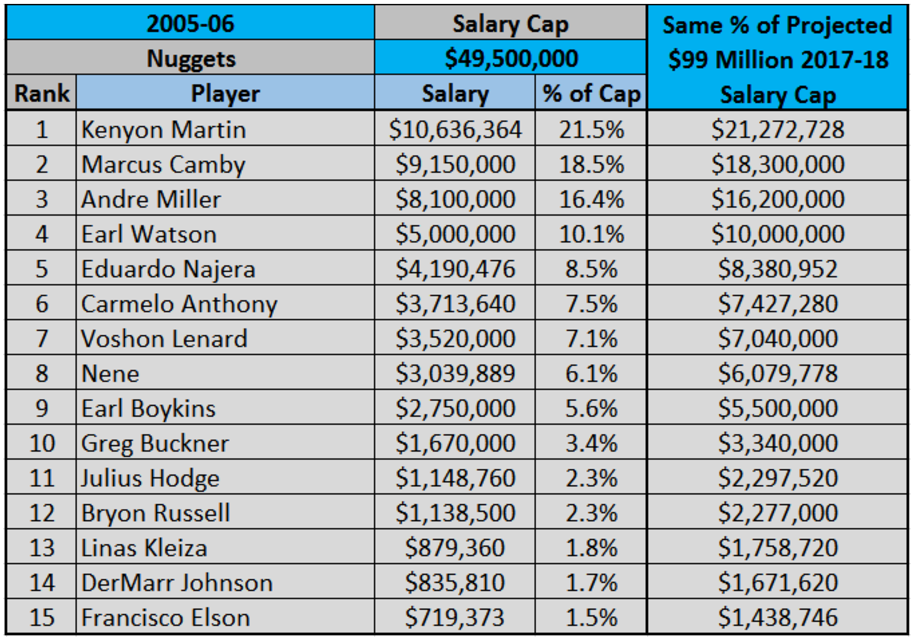

Returning to that 2005-06 season with Martin topping Denver’s payroll, here is a look at the salaries of the complete roster, and the percentage of that year’s $49.5 million salary cap which each salary comprised:

Although Carmelo Anthony was clearly the Nuggets’ best player at the time, he was still on his rookie contract, leaving Martin and Marcus Camby as Denver’s two top-paid players, each earning approximately 20 percent of the salary cap, with Andre Miller coming in a close third at 16.4 percent of the cap. These three players combined to earn 56.3 percent of the cap, with the remaining players rounding out the payroll.

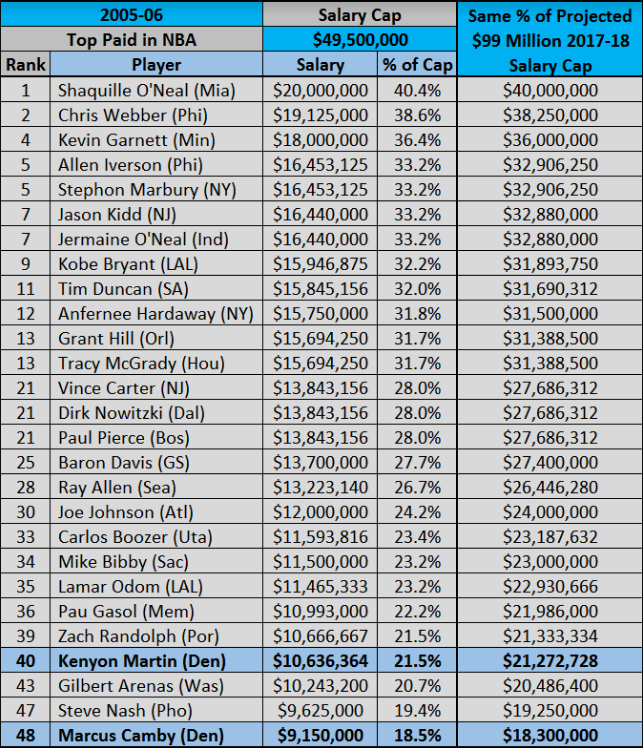

As the Nuggets were essentially still in rebuilding mode, they did not at that time have any of the league’s highest paid players on their roster. So to get a clearer concept of where that bar was set, it will be helpful to compare Denver’s salaries with the biggest in the NBA that season. (For the sake of brevity, not all names are included in the “Top Paid in NBA” tables.)

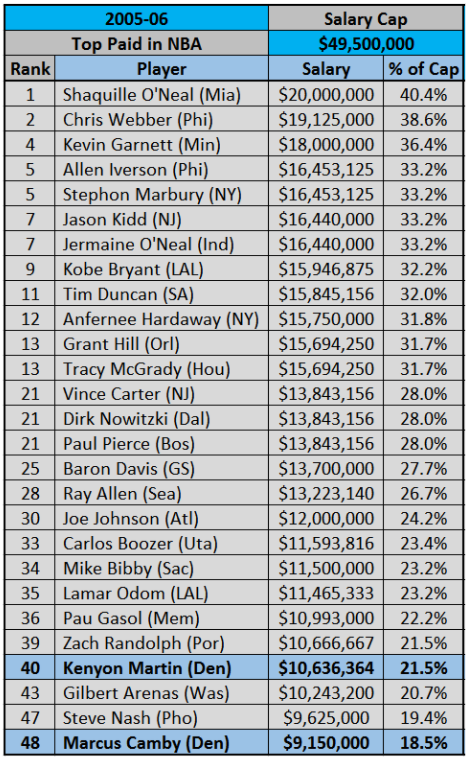

Here we can see that Shaquille O’Neal, the top bread winner with a $20 million salary that almost seems modest by today’s standards, made about double what Martin pulled in. Roughly speaking, the league’s top 15 or so highest paid players, with salaries ranging from approximately 30 to 40 percent of that season’s $49.5 million salary cap, made around one-and-a-half to two times Denver’s top earners, who ranked in the forties among all top paid NBA players.

Which brings us, having reviewed a past NBA payroll profile that many might find more familiar than the current environment under the new TV deal and CBA, to where the rubber meets the road.

Understanding new NBA salaries as a percentage of the salary cap

Although the salary cap for the upcoming 2017-18 NBA season will not be officially set until July 12, the day following the July 1-11 free agency moratorium, the NBA informed teams last week that it had revised its previous salary cap projection for next season downward from $101 million to $99 million.

This projected $99 million cap announcement allows teams to prepare their books for the beginning of free agency in July and gives us a framework for putting past NBA salaries into the context of the new CBA for the sake of comparison. With such a huge difference in the dollar values of new contracts, using salary cap percentages to weight them against the contracts many of us may be more familiar with will hopefully help in getting a better visceral feel for current and future contract values.

Let’s have another look at those 2005-06 salaries, but this time with one additional column showing what, as a percentage of the projected $99 million salary cap, the equivalent salaries would look like in 2017-18. First, the Nuggets again:

And that season’s highest-paid NBA players:

Going back to our original question, should NBA teams this summer consider the $23.5 million per year range, in line with the contracts extended to Barnes and Parsons last summer, as being of appropriate value for Gallinari?

If we convert 2005-06 salary cap percentages to 2017-18 dollar values, that would put Gallinari atop the Nuggets payroll just ahead of the $21.3 million Martin would be making, but around 30th to 35th in the league, among the likes of Carlos Boozer, Mike Bibby, and Lamar Odom, all in the vicinity of the 23.7 percent which $23.5 million comprises of the projected $99 million 2017-18 salary cap.

Although it still may be difficult to get past the staggering amount of the outright dollar value, viewed in this context as a percentage of the newly spiked salary cap, valuing Gallo at $23.5 million may not actually be as outlandish a notion as it could seem at first. And here I should note that although, as I wrote about previously, Gallinari’s production and efficiency might be difficult for the Nuggets to replace. My aim here is not necessarily to advocate for the Nuggets to pay Gallinari this much, or even re-sign him at all. Rather, to create a frame of reference for his general market value for any team.

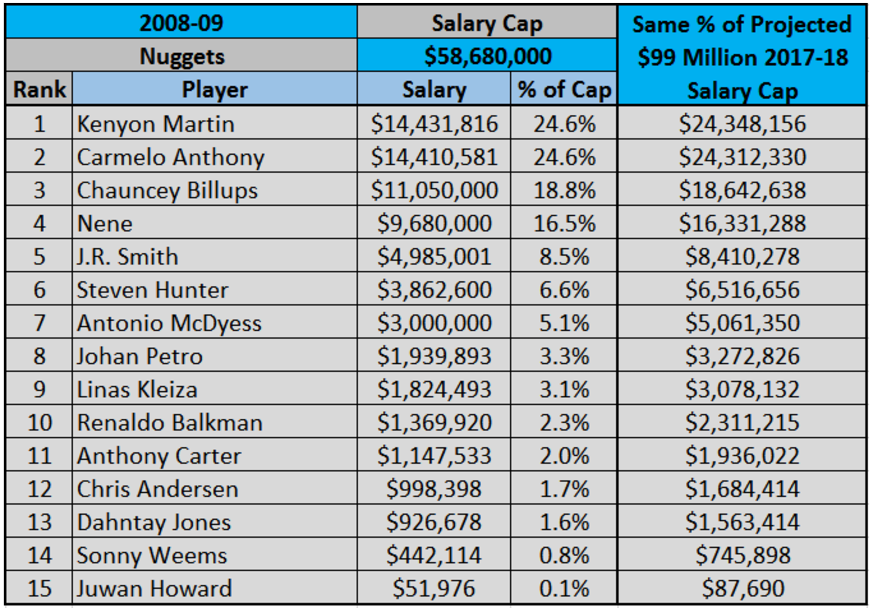

In the case of the Nuggets in particular, the 2008-09 season roster might represent a more typical payroll structure of the kind Denver will likely have soon, as Anthony and Nene were, by then, on their first contract extensions – as Harris, Nikola Jokic, and others should be in the near future.

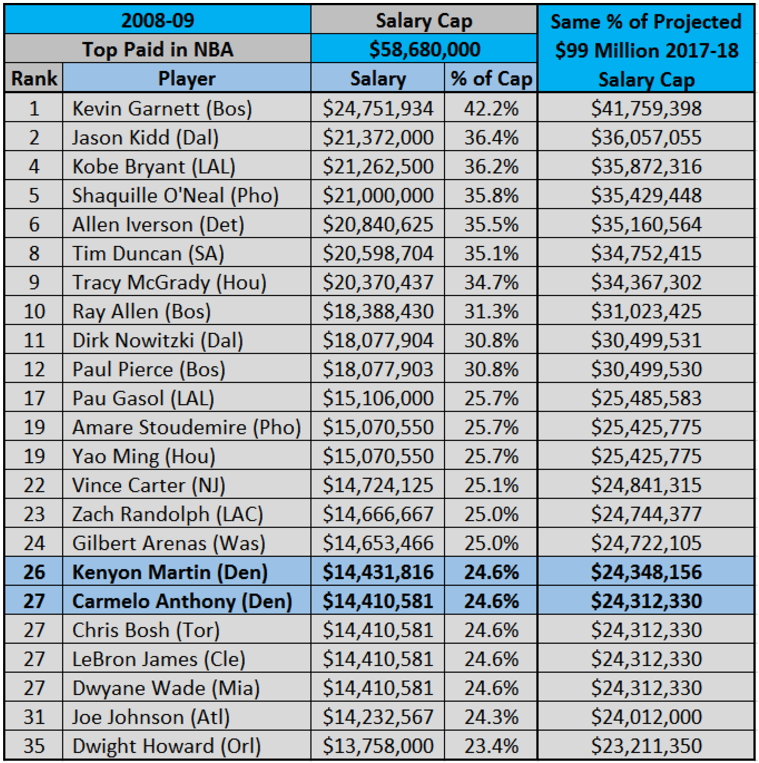

We can also see in looking at that season’s highest-paid players that with raises and extensions the top earning Nuggets were creeping up the league’s ranks into the mid-20s:

Here again, a Barnes- or Parsons-like contract would put Gallo in the range of the 35th highest paid player in the league, right on par with what Dwight Howard was making in 2008-09, and near the top of the Nuggets’ payroll. We also see a similar pattern in that the approximately 15 top paid players make 30 to 40 percent of the cap, with the next several dozen ranging in the 20s.

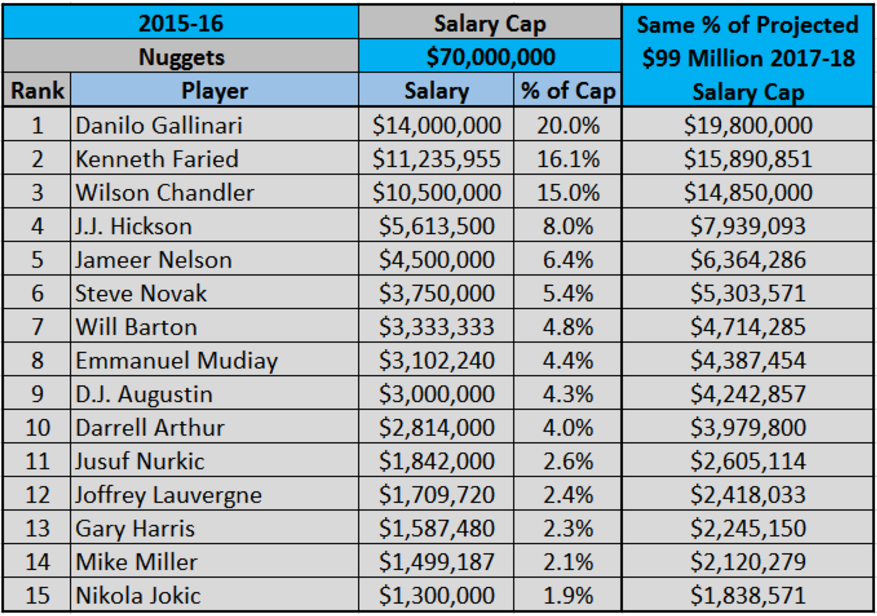

Coming closer to the present, in the year prior to last season’s cap spike, we can see that once again, similar trends hold for the Nuggets:

In fact, although in dollars Gallinari’s salary would jump from $14 million to $23.5 million under our hypothetical payout, that would represent a fairly modest raise relative to the salary cap from 20 percent to 23.7 percent.

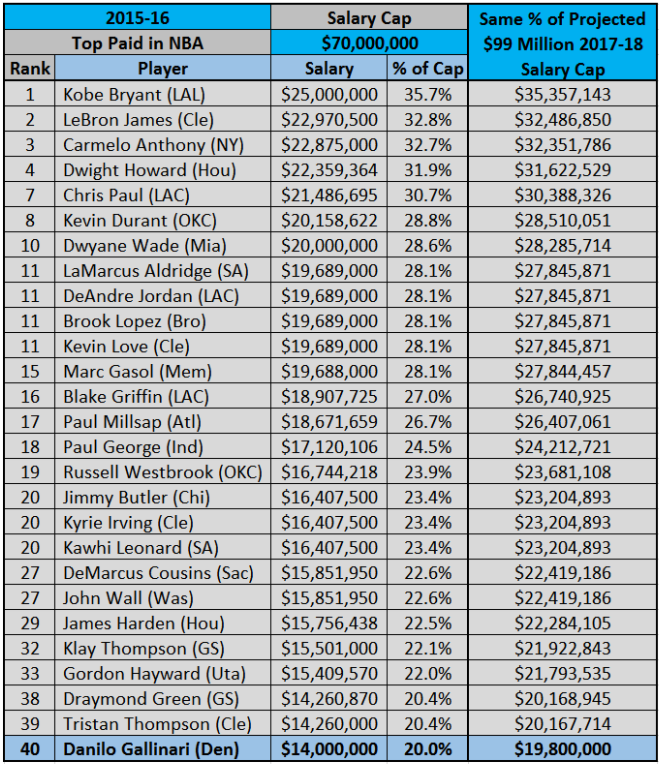

Once difference from 2008-09 to 2015-16, however, is that the highest paid players were making less of a percentage of the salary cap, with the top 15 now ranging from about 28 to 36 percent, rather than 30 to 40:

Because of this, a salary which was 23.7 percent of the salary cap would then be in the mid-20’s among the top paid players, rather than the low thirties. Still, not altogether unreasonable for a veteran entering his ninth season who probably should rank around 40th best player in the league.

The bottom line

Irrespective of whether the Nuggets re-sign Gallinari – I happen to doubt they will, but we shall see – the essential point here is to use the example of the salary amount he is likely to get paid regardless of which team signs him as a device for putting all of these new, seemingly (or perhaps legitimately) extravagant NBA salaries into a context which can be more easily understood.

Hopefully, this summer and into the future Tim Connelly and Arturas Karnisovas will make prudent decisions for the Nuggets front office, getting good value for great players, but the whole framework for understanding what “prudent” means has shifted considerably.

If Evan Fournier is averaging $17 million, and Allen Crabbe $18.8 million a year, would it be unfair for Harris to expect a similar extension? It seems like a lot on the surface, but viewed as a percentage of the cap it could actually be seen as fairly reasonable. It would be, after all, just a bit more than 2005-06 Andre Miller.

And under the new CBA, maximum contracts for players in their first six years are set at 25 percent of the salary cap. So when Jokic extends for over $25 million a year starting in 2018-19, when the cap is projected to be $102 million, that will be about the same as what Anthony and Martin were making in 2008-09.

It’s shocking, yes, but just par for the new NBA course.

Comments

Share your thoughts

Join the conversation